Apple Pay is finally on the horizon for India but its journey to launch has been far from straightforward. Although millions of Indians rely on digital payments every day, Apple’s contactless mobile wallet solution has struggled to enter the world’s fastest‑growing payments market. In this blog, we’ll break down why Apple Pay took so long to come to India, the challenges it faces with local payment systems like UPI, the timeline for launch, and the kinds of customers who are most likely to embrace it once it goes live.

Why Apple Pay Has Taken So Long to Launch in India

Regulatory Challenges and Compliance

India has strict rules for how payment data must be handled and stored. Any digital payment service must adhere to requirements that protect customer data and ensure financial transparency. Apple’s global approach to security and privacy had to be aligned with these local regulations, which slowed down the rollout process.

India also requires payment services to meet specific tokenization and device authentication standards. Apple Pay uses advanced encryption and tokenization to secure transactions, but making sure this technology matched regulatory expectations took time and careful negotiation.

The Dominance of UPI in India

One of the biggest reasons Apple Pay hasn’t launched yet is the challenge posed by India’s Unified Payments Interface (UPI). UPI is a real‑time bank‑to‑bank transfer system used by hundreds of millions of people across India. It has become the primary way Indians pay digitally, especially through QR codes and instant money transfers.

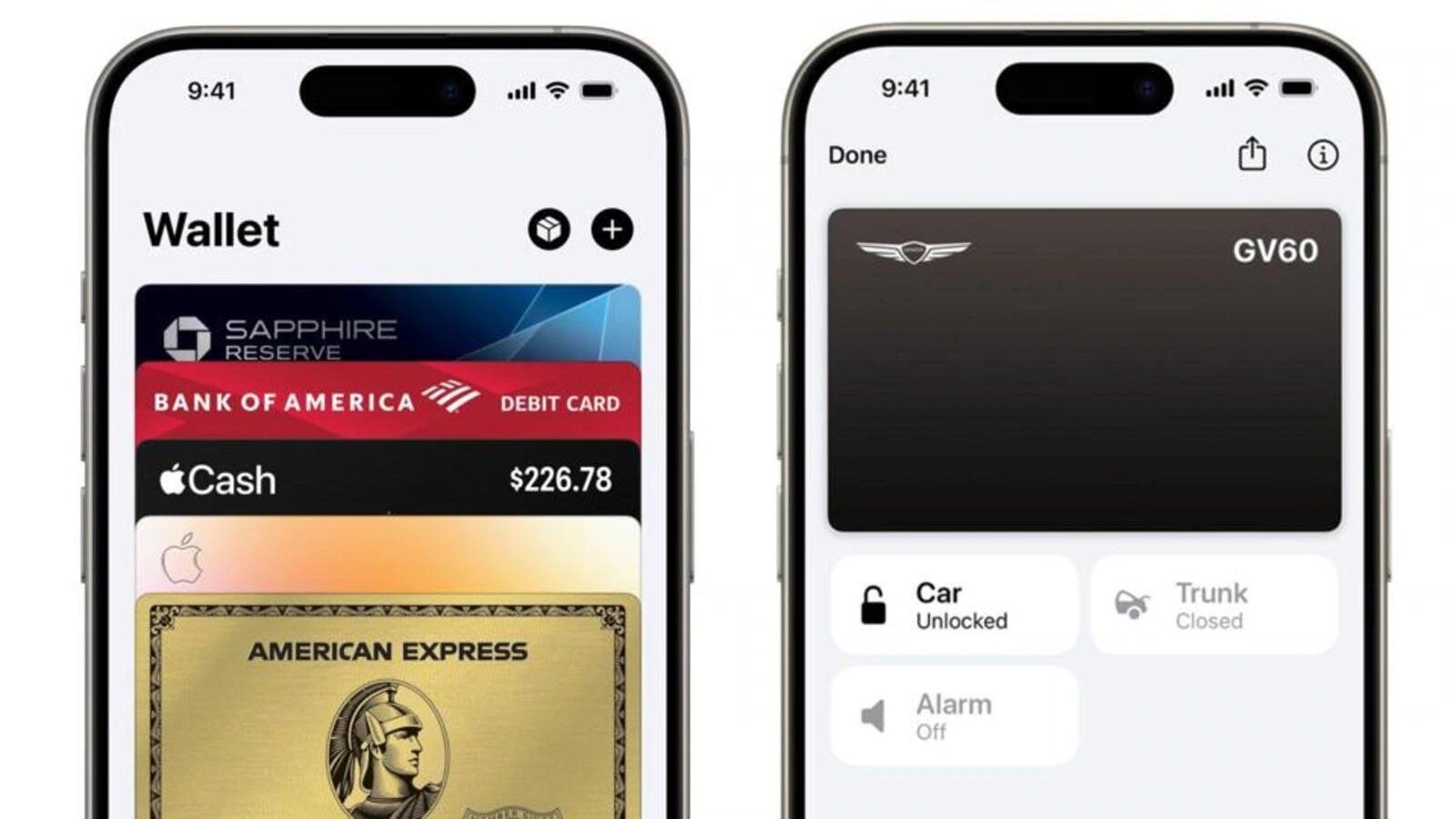

Apple Pay, in contrast, is built around card‑based contactless payments using NFC technology. India’s digital ecosystem is deeply rooted in UPI, and Apple’s preference for card‑centric systems created a hurdle. Adding to the complexity, UPI integration requires additional approvals and compliance with strict NPCI guidelines a process that has taken longer than expected.

Partnerships with Banks and Card Networks

To launch Apple Pay, Apple must work closely with Indian banks and global card networks like Visa and Mastercard. Negotiating these partnerships and testing integrations takes time, especially in a market where banks already have favored relationships with UPI‑based wallets.

These complex technical and business arrangements contributed significantly to the delay.

Point‑of‑Sale Readiness

Apple Pay relies on NFC contactless payment infrastructure technology that allows users to tap their device at a payment terminal. In many parts of India, QR‑based payments are more common, and not all merchants are yet equipped with NFC payment terminals.

Apple needed confidence that enough merchants could accept this newer form of payment to justify a full launch.

Expected Launch Timeline for Apple Pay in India

After extended discussions and testing, Apple Pay is now expected to launch in India sometime later this year. While an exact date hasn’t been officially announced, the service is anticipated to go live by the end of the year.

This initial rollout will be centered on contactless card payments, allowing users to add debit and credit cards to Apple Wallet and pay using their iPhone or Apple Watch at NFC‑enabled terminals.

Integration with UPI may come later, but it’s unlikely to be part of the first launch phase due to regulatory and technical complexities.

Who Are the Potential Customers for Apple Pay in India?

Even though Apple Pay enters a UPI‑dominated market, it has several distinct customer segments that may adopt it rapidly:

1. Apple Device Owners

This is the most obvious group: people who already use iPhones or Apple Watches. Apple Pay will work seamlessly on these devices, making it a convenient choice for device owners.

2. Credit and Debit Card Users

People who prefer using cards especially premium credit cards with rewards may enjoy Apple Pay’s secure and fast checkout experience.

3. Urban Shoppers and Frequent Consumers

City‑based shoppers, diners, and regular buyers who value tapping to pay instead of scanning QR codes may find Apple Pay especially convenient.

4. Travelers and International Shoppers

Because Apple Pay is accepted in many countries, Indians who travel abroad or make international online purchases may appreciate the consistency of using the same payment method globally.

5. Tech‑Savvy and Security‑Conscious Users

Apple Pay’s biometrics and tokenization offer enhanced security features that appeal to users who prioritize privacy and fraud protection.

6. Premium Market Segments

Apple positions its services toward users with higher disposable incomes a segment of the Indian market that continues to grow.

Apple Pay vs UPI: How They Compare

While UPI dominates daily transactions in India, Apple Pay offers something different rather than direct competition:

- UPI: Instant transfers, QR‑based payments, and wide adoption across all budgets and regions.

- Apple Pay: Premium contactless experience tied to Apple devices and cards, focused on convenience and security.

Many experts believe Apple Pay will complement UPI instead of replacing it providing an alternative for users who want a different kind of digital payment experience.

Summing Up

Apple Pay’s arrival in India represents a significant milestone in the evolution of digital payments in the country. Although the delay was driven by regulatory, technical, and market challenges particularly around UPI integration the service is now poised for launch. While UPI will remain dominant for most everyday transactions, Apple Pay’s seamless NFC payments, strong security, and integration with Apple devices make it an attractive option for select customer segments.

Stay tuned as Apple continues to roll out this service and potentially expands it with more features tailored to the Indian market.

FAQs

Q1. When will Apple Pay launch in India?

Apple Pay is expected to launch later this year, with contactless card‑based payments available first.

Q2. Will Apple Pay support UPI?

UPI integration is likely to come later, not in the initial launch phase.

Q3. Can any Indian bank card be added to Apple Pay?

Most major credit and debit cards should be supported, but availability will depend on partnerships finalized before launch.

Q4. Is Apple Pay better than UPI?

It’s different — Apple Pay offers a premium, secure NFC payment experience, whereas UPI remains the most widely used everyday payment method in India.

Comments (0)

Join the conversation

No comments yet. Be the first to share your thoughts!