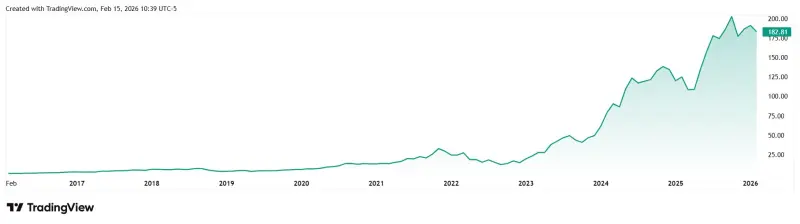

The AI industry is experiencing unprecedented growth. Investment is flowing in at record levels, valuations are soaring, and it seems like every company is racing to add "AI" to their products. But as with any rapidly growing sector, questions are emerging about sustainability.

I've been following tech trends for a while now, and I think it's worth examining both sides of the AI investment debate. Let's look at what the data actually tells us.

The ROI Challenge

According to research from Gartner, a significant number of AI investments are struggling to deliver measurable returns. Their findings suggest that many companies are still figuring out how to extract real value from their AI implementations.

This doesn't mean AI doesn't work — it means the gap between implementation and ROI is wider than many expected. Enterprise AI adoption is a complex process, and results vary widely depending on use case, industry, and execution.

Historical Parallels Worth Considering

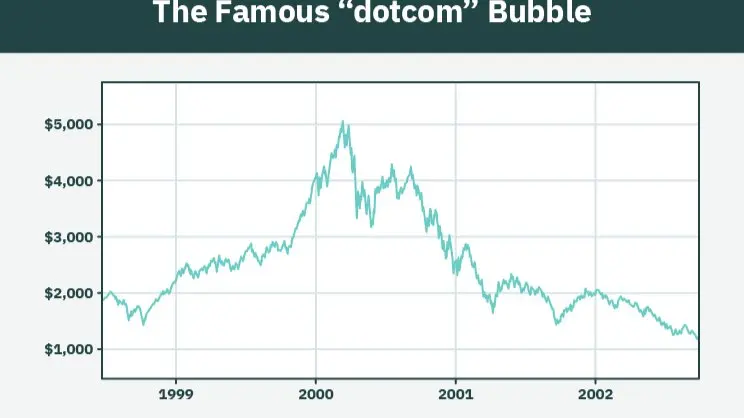

Some analysts have drawn comparisons between the current AI investment landscape and previous tech cycles, including the dot-com era of the late 1990s.

The similarities they point to include:

- High valuations for companies still developing their business models

- Significant infrastructure spending

- Strong investor enthusiasm

However, there are also important differences. Unlike many dot-com companies, today's AI leaders have functional products, substantial revenue streams, and backing from well-capitalized tech giants. Companies like Microsoft, Google, and Amazon have the resources to invest for the long term.

Whether this cycle plays out differently remains to be seen.

The Evolution of AI Agents

There's been considerable excitement around "agentic AI" autonomous systems designed to handle complex tasks with minimal human oversight. According to industry analysts, this technology is currently going through a maturation phase.

Early implementations have faced challenges around reliability and security. This is normal for emerging technology the first versions rarely meet the full scope of initial expectations. The question isn't whether AI agents will work, but how long the development cycle will take.

Different Perspectives on What's Next

The cautious view: Some market observers believe a correction may be coming. They argue that expectations have outpaced current capabilities, and that valuations in some cases may not be sustainable.

The optimistic view: Others point out that AI technology is fundamentally sound and improving rapidly. They see current investments as laying groundwork for long-term value creation, even if short-term returns are mixed.

The middle ground: Many analysts suggest we may see a "normalisation" rather than a crash — a period where hype cools down, weak players exit, and sustainable businesses emerge stronger.

Emerging Trends Worth Watching

One interesting development is the growing interest in smaller, specialised AI models. Industry leaders are exploring whether fine-tuned smaller models might be more cost-effective for specific business applications than larger, general-purpose systems.

This shift toward practicality over scale could reshape how companies approach AI implementation in the coming years.

What This Might Mean for Different Stakeholders

For investors: As with any emerging sector, diversification and due diligence remain important. Understanding a company's actual AI capabilities versus marketing claims can help inform decisions.

For businesses: Focusing on specific, measurable use cases rather than broad AI transformation may yield better results. Many successful implementations start small and scale based on proven value.

For professionals: AI tools that work today will likely continue improving. Staying informed about developments without getting caught up in hype cycles can help you make practical decisions about which tools to adopt.

The Bigger Picture

Regardless of what happens to valuations or stock prices, the underlying AI technology continues to advance. Models are becoming more capable, costs are decreasing, and practical applications are expanding.

The real question isn't whether AI is valuable it clearly is. The question is whether current market expectations align with realistic timelines for that value to materialise.

History suggests that transformative technologies often go through cycles of hype and correction before finding their sustainable path. AI may follow a similar pattern.

What's your take on the current state of AI investment? Share your thoughts in the comments below.

Sources and Further Reading:

- Gartner Research on AI ROI

- MIT Sloan Management Review: AI Trends Analysis

- TechCrunch: AI Industry Coverage

Comments (0)

Join the conversation

No comments yet. Be the first to share your thoughts!