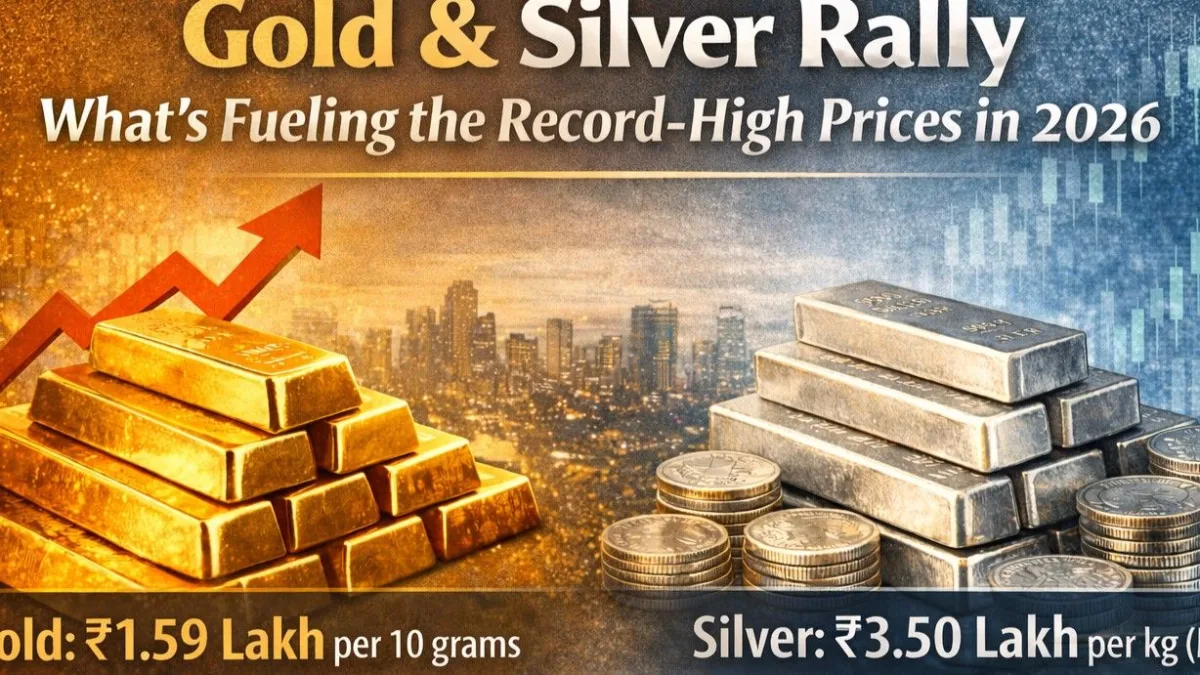

Historic Bullion Rally: Where Prices Stand Today

In early 2026, both gold and silver have hit record‑breaking price levels in India. On the MCX, gold futures briefly touched around ₹1.59 lakh per 10 grams, while silver futures climbed past ₹3.50 lakh per kilogram all‑time highs for domestic bullion markets.

This extraordinary rally follows global commodity trends where gold has surpassed $5,000 per ounce and silver has traded above $100 per ounce on international markets.Such pricing is mirrored in Indian rupees because bullion is priced based on global benchmarks and then converted using the international dollar‑rupee exchange rate, adding domestic taxes and premiums.

Safe‑Haven Demand and Global Economic Uncertainty

One of the most powerful forces behind the surge is safe‑haven buying by global and domestic investors. When economic growth slows, geopolitical tensions escalate, or markets wobble, investors flock to precious metals seen as stores of value.

Major geopolitical flashpoints - trade tensions, conflicts in Ukraine and the Middle East, and uncertainty around U.S. fiscal policy - have shaken confidence in equity and currency markets. This has driven both retail and institutional money into gold and silver as hedges against risk.

Central banks worldwide are also adding to gold reserves to reduce reliance on U.S. dollar‑denominated assets, further tightening supply and supporting prices.

Currency Movements and Import Cost Pressures

In India, bullion prices are especially sensitive to the value of the rupee against the U.S. dollar. A weaker rupee makes imported gold and silver more expensive in domestic terms. Over recent months, the rupee has remained under pressure, which has amplified price moves in Indian markets.

Additionally, speculation around import duty changes ahead of the Union Budget has led traders to increase premiums on gold and silver, making local prices even higher.

Because India imports most of its gold and silver, any shifts in global prices, shipping costs, or exchange rates translate directly into higher spot prices for consumers and investors.

Silver’s Unique Dual Demand: Investment + Industry

While gold’s rally is driven almost entirely by investment demand, silver benefits from a double‑edged surge both as a precious metal and as an industrial commodity.

Silver is used extensively in solar panels, electronics, electrical contacts, and renewable energy technologies. Continued growth in these industries puts added pressure on supply. Combined with tight global inventories and structural demand outpacing mine production, this has helped silver prices outperform gold in percentage terms.

This industrial backdrop, along with strong investment interest particularly in physical silver bars, coins, and ETFs has accelerated silver’s run to record levels in rupee terms.

Market Psychology, Speculation, and Future Outlook

Another important factor is market psychology. With both metals hitting new highs, a fear‑of‑missing‑out (FOMO) dynamic has pushed more investors into precious metals, reinforcing the upward move. Retail flows into gold and silver vehicles, including ETFs and futures, have been robust.

Forecasts from research bodies suggest that gold could reach ₹1.75 000–₹1.95 000 per 10 grams and silver might climb to ₹3.80 000–₹4.60 000 per kg by end of 2026 if current trends continue.

However, experts also caution that volatile currencies, global monetary policies, and potential profit‑taking could introduce corrections in the short term. Strong prices might temper consumer demand, especially in price‑sensitive markets like jewellery.

What we have learned

The skyrocketing prices of gold and silver in 2026 are not driven by a single cause they are the result of interlinked global economic, geopolitical and financial forces:

- Investors turning to metals as a hedge against uncertainty and inflation.

- A weaker rupee and import cost pressures in India.

- Structural demand for silver from emerging industries.

- Ongoing capital flows and speculative interest in bullion.

Comments (0)

Join the conversation

No comments yet. Be the first to share your thoughts!